Personal Tax:

There are no proposal for changes in the income tax rates in Budget except change in individual income tax slabs, which is as under:

• Individual, HUF, AOPs and BOIs

FY 2013-14 TAX RATE PROPSED FY 2014-15 TAX RATE

Upto Rs .2,00,000 Nil Upto Rs .2,00,000 Nil

Rs. 2,00,000 to Rs. 2,50,000 Tax @ 10.30% Rs. 2,00,000 to Rs. 2,50,000 Nil

Rs 2,50,001 to Rs 5,00,000* Rs. 5,150 plus tax @ 10.30% Rs 2,50,001 to Rs 5,00,000* Tax @ 10.30%

Rs 5,00,001 to Rs 10,00,000** Rs. 30,900 plus tax @ 20.60% Rs 5,00,001 to Rs 10,00,000** Rs. 25,750 plus tax @ 20.60%

Rs. 10,00,000 to Rs. 1 crore Rs. 1,33,900 plus tax @ 30.90% Rs. 10,00,000 to Rs. 1 crore Rs. 1,28750 plus tax @ 30.90%

Above Rs. 1 crore Rs. 29,14,900 plus tax @33.99% Above Rs. 1 crore Rs. 29,09,750 plus tax @33.99%

* In case of a resident individual of the age of 60 years or more (senior citizen) at any time during the previous year, the basic exemption income slab of Rs. 3,00,000. The relief on overall tax would from the above be Rs. 5,150 for FY 2013-14 and Rs. 10,300 for FY 2014-15

** For resident individual of the age of 80 years or more (very senior citizen) at any time during the previous year the basic exemption income slab of Rs. 5,00,000 continues to remain the same.

Tax rates of Partnership firm and Limited Liability Partnership (LLP):

• There is no change in the existing tax rates of partnership firms and LLP.

• There is no changes in Alternate Minimum Tax on firms

Corporate taxation:

• There is no change in the tax rates and Minimum Alternate Tax (MAT) of domestic company and foreign company.

• There is no change in the rates of Dividend Distribution Tax.

Domestic Company Foreign Company

Total income FY 2013-14 FY 2014-15 FY 2013-14 FY 2014-15

-Below 1 Cr 30.90% 30.90% 41.20% 41.20%

-Between Rs. 1 Cr to Rs. 10 Cr 32.45% 32.45% 42.02% 42.02%

-Above Rs. 10 Cr 33.99% 33.99% 43.26% 43.26%

1.2. Budget proposal for personal taxation

• The personal income tax slabs is increased from Rs. 2,00,000 to Rs. 2,50,000 for an Individual (below 60 years) Hindu undivided family, association of persons, body of individuals, artificial juridical person

• The income tax slabs for senior citizen (from 60 years to 80 years) increased from Rs. 2,50,000 to Rs. 3,00,000.

• The limit for claiming deduction under section 80C is increased from Rs. 1,00,000 to Rs. 1,50,000. Correspondingly even the maximum investment in PPF is increased to Rs.1,50,000 per year.

• The limit for claiming deduction of interest on housing loan in increased from Rs. 1,50,000 to Rs. 2,00,000.

• Tax Deducted at Source (‘TDS’) @ 2% on maturity / bonus paid under Life Insurance policy, ONLY which are NOT EXEMPT under Income tax Act.

1.3. Budget proposal for business:

• Units and Unlisted Securities would be Long Term Capital Asset, if they are held for more than 3 years, instead of earlier holding period of One year.

• Deduction of 15% on acquisition and installation of new plant and machinery upto Rs. 25 Crores (till 31.03.2017) to the companies engaged in the business of manufacture or production of an arti¬cle or thing.

• The eligibility for claiming deduction under section 80-IA of the Act is extended upto 31 March 2017 in case of undertaking engage in generation of power or starts transmission or distribution by laying a network of new transmission or distribution lines or undertakes substantial renovation and modernization of existing network of transmission or distribution lines

• Two new businesses are cover under the ambit of section 35AC of the Act for claiming deduction in respect of expenditure incurred in case of laying and operating a slurry pipeline for the transpor¬tation of iron ore and setting up and operating a semiconductor wafer fabrication manufacturing unit, if such unit is notified by the Board in accordance with the prescribed guidelines.

• Concessional rate of deduction of tax @5% on overseas borrowing including External Commercial Borrowing (‘ECB’) under loan agreement, before 01.07.2017, is now also applicable for issue of ANY Long-Term Bond, which earlier was restricted to a long term infrastructure bonds.

• Advance or token received for proposed sale of any Property / Capital Asset which was forfeited was earlier not liable to tax in the year of receipt and now from this year, it will be taxable as ‘income from other sources’.

• Non-deduction or non-payment of TDS on payments made to residents as specified in section 40 (a)(ia) of the Act, the disallowance shall be restricted to 30% of the amount of expenditure claimed. Earlier the entire amount was disallowed. Further all expenditure are covered into this section, which earlier was not covered for Salary, Director fees.

• The Eligible Transaction in respect of trading in Commodity Derivatives carried out in a Recog-nised Association and chargeable to commodities transaction tax under Chapter VII of the Finance Act, 2013 shall not be considered to be a speculative transaction.

• The Explanation to section 73 so as to provide that the provision of the Explanation shall not be applicable to a company the principal business of which is the business of trading in shares.

1.3. Budget proposal for business

• The Explanation to section 73 so as to provide that the provision of the Explanation shall not be appli¬cable to a company the principal business of which is the business of trading in shares.

• It is proposed that Mutual Funds, Securitization Trusts and Venture Capital Companies or Venture Capital Funds shall file return of income if the total income in respect of which such fund, trust or company is assessable, without giving effect to the provisions of section 10, exceeds the maximum amount which is not chargeable to income-tax, as prescribed under sub-section (1) of section 139.

• It is proposed to amend the provisions of the sections 269SS and 269T so as to provide that any acceptance or repayment of any loan or deposit by use of electronic clearing system through a bank account shall not be prohibited under the said sections if the other conditions regarding the quantum etc. are satisfied.

• Alternate Minimum Tax (akin to MAT for Companies) credit of earlier years will now be available, even if the Adjusted total income is less than 20 lakhs in current year, which was not allowed earlier. This section was relevant to an individual or an HUF or an association of persons or a body of individuals.

1.4. Budget proposal non-resident/Transfer Pricing :

• Concessional rate of tax of 15 % on dividend received by an Indian company from its foreign Com-pany is proposed to be continued for AY 2015-16 and subsequent years.

• It is proposed to provide “Roll Back” mechanism for dealing with Arm’s Length Price (ALP) issues in case of Advance Pricing Agreement (APA). The “Roll Back” provisions refers to the applicability of the methodology of determination of ALP, to be applied to the International Transactions which had al¬ready been entered into in a period prior to the period covered under an APA.

• It is proposed to amend the Act to provide that any security held by Foreign Institutional Investor (FII) which has invested in such security in accordance with the regulations made under the Securities and Exchange Board of India Act, 1992 would be treated as capital asset only and income there from would be in the nature of capital gain.

• It is proposed to provide that any transfer of a capital asset, being a Government Security carrying a periodic payment of interest, made outside India through an intermediary dealing in settlement of secu¬rities, by a non-resident to another non-resident shall not be considered as transfer for the pur¬pose of charging capital gains.

• The range concept to be introduced for determination of arm’s length price under the transfer pricing regulations. It is proposed to allow use of multiple year data for comparability analysis under the trans¬fer pricing regulations.

1.5. Budget proposal –Others :

• To rationalize the provisions relating to cancellation of registration of a trust, it is proposed to amend section 12AA of the Act to provide that where a trust or an institution has been granted registration, and subsequently it is noticed that its activities are being carried out in the following manner then the Principal Commissioner or the Commissioner may cancel the registration if such trust or institution does not prove that there was a reasonable cause for the activities to be carried out in that manner.

(i) its income does not endure for the benefit of general public;

(ii) it is for benefit of any particular religious community or caste (in case it is established after commencement of the Act);

(iii) any income or property of the trust is applied for benefit of specified persons like author of trust, trustees etc.; or

(iv) its funds are invested in prohibited modes,

• Any expenditure incurred by an assessee on the activities relating to corporate social responsibility referred to in section 135 of the Companies Act, 2013 shall not be deemed to have been incurred for the purpose of business and hence shall not be allowed as deduction under section 37.

However, the CSR expenditure which is of the nature described in section 30 to section 36 of the Act shall be allowed deduction under those sections subject to fulfillment of conditions, if any, specified therein.

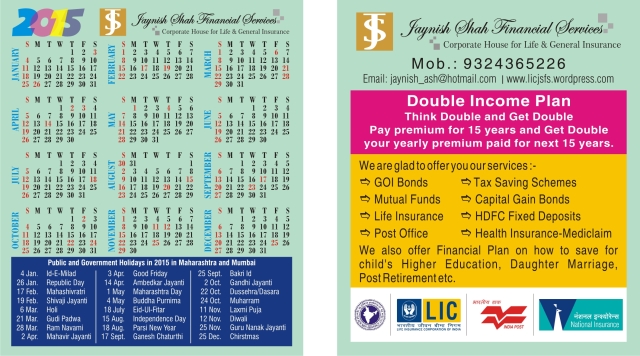

JAYNISH SHAH FINANCIAL SERVICES

00 91 9324365226

jaynish_ash@hotmail.com